|

It is completely free of cost.

|

|

No, This service can only be used if you do not have a PAN but have a valid Aadhaar and your KYC details are updated.

|

|

Individual who has not been allotted a PAN

|

|

Valid Aadhaar and mobile number linked to Aadhaar

|

|

User not a minor as on date of request; and

|

|

User not covered under the definition of Representative Assessee u/s 160 of the Income Tax Act.

|

|

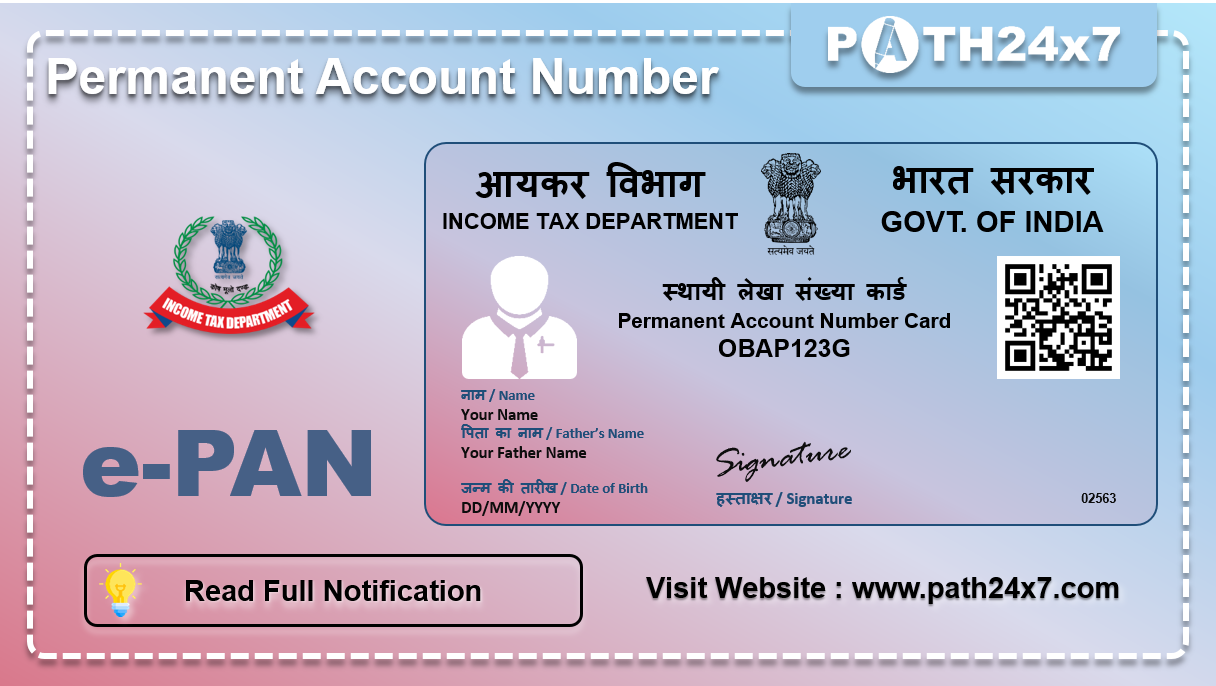

It is mandatory to quote your Permanent Account Number (PAN) while filing your Income Tax Return.

|

|

If you have not been allotted a PAN, you can generate your e-PAN with the help of your Aadhaar and a mobile number registered with your Aadhaar.

|

|

Generating e-PAN is free of cost, online process and does not require you to fill up any forms.

|

|

Step 1 : Go to the e-Filing portal homepage, click Instant e-PAN

|

|

Step 2 : On the e-PAN page, click Get New e-PAN.

|

|

Step 3 : On the Get New e-PAN page, enter your 12-digit Aadhaar number, select the I confirm that checkbox and click Continue.

|

|

Note :

|

|

Step 4 : On the OTP validation page, click I have read the consent terms and agree to proceed further. Click Continue.

|

|

Note :

|

|

Step 6 : On the Validate Aadhaar Details page, select the I Accept that checkbox and click Continue.

|

|

Note:

|

|

On successful submission, a success message is displayed along with an Acknowledgement Number. Please keep a note of the Acknowledgement ID for future reference. You will also receive a confirmation message on your mobile number linked with Aadhaar.

|

|

Step 1 : Go to the e-Filing portal homepage and click Instant e-PAN.

|

|

Step 2 : On the e-PAN page, click Continue on the Check Status / Download PAN option.

|

|

Step 3 : On the Check status / Download PAN page, enter your 12-digit Aadhaar and click Continue.

|

|

Step 4 : On the OTP Validation page, enter the 6-digit OTP received on your mobile number registered with Aadhaar and click Continue.

|

|

Note:

|

|

Step 5 : On the Current status of your e-PAN request page, you will be able to see the status of your e-PAN request. In case the new e-PAN has been generated and allotted, click View e-PAN to view or Download e-PAN to download a copy. Click Create e-Filing Account to register on the e-Filing portal.

|

|

Note : If did not validate your email ID (as per your Aadhaar KYC) when generating your e-PAN, or while updating PAN details, it is compulsory to do so during registration.

|

|

Step 1 : Log in to the e-Filing portal using your User ID and password.

|

|

Step 2 : On your Dashboard, click Services > View / Download e-PAN.

|

|

Step 3 : On the Enter Aadhaar Number page, enter your 12-digit Aadhaar number and click Continue.

|

|

Step 4 : On the OTP Validation page, enter the 6-digit OTP received on your mobile number registered with Aadhaar and click Continue.

|

|

Note:

|

|

Step 5 : On the View / Download e-PAN page, you will be able to see the status of your e-PAN request. In case the new e-PAN has been generated and allotted, click View e-PAN to view or Download e-PAN to download a copy.

|